What effect are Trump’s policies having on global markets?

Tuesday last week marked 50 days of the new US President Donald Trump’s administration. We are already seeing the potential implications of an increasingly inward America and what the end of US exceptionalism could mean, not just for markets but for the wider balance of global economics.

We see three broad themes that investors are now grappling with:

The Trump administration is following through on a campaign promise to use a carrot-and-stick approach to enforce a Made-In-the-USA policy. The carrots are tax cuts and deregulation promised to companies looking to locate their businesses in the US, the stick is tariffs being placed on cross-border trade.

Europe, having been caught in a state of unpreparedness, must stand on its own two feet when it comes to industrial policy, energy and defence. The lack of the former two have left the continent overly reliant on the wider trend of increasing globalisation and the period of relative peace since the end of the cold war, while the latter has left European nations heavily reliant on the US defence umbrella.

While the first Trump administration (2017-2021) ushered in a period of relative calm for markets (2017 saw historic lows for equity market volatility leading to a melt up in asset prices), the second Trump administration has hit the ground running with an ambitious agenda to change the balance of the global economy.

The market reaction

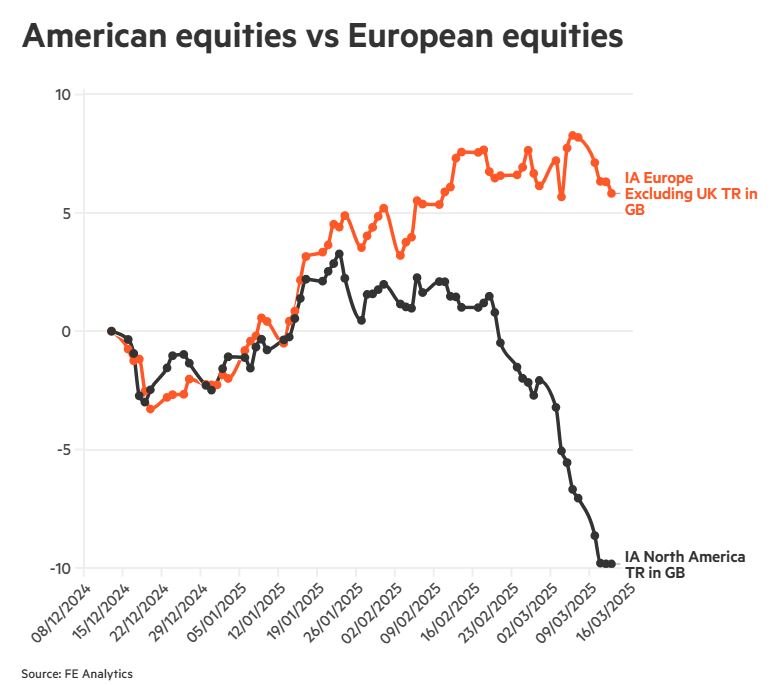

Following a prolonged period of outperformance by US markets versus the rest of the world, investors are now reacting to a rapid readjustment in asset price performance where the US is giving up some ground.

But as we explore here, we see this as a healthy development in what had become a very concentrated market. One of the largest comeback stories in the past two months has been the long-suffering European equity market.

Having posted a meagre return through most of 2024 (in US dollar terms), the anticipation of higher fiscal spending in areas such as infrastructure and defence has sparked a fresh rally.

What is interesting about these recent moves is the divergence in underlying sector performance. For a long time, equities within each sector – regardless of the geographic location of their listings – would have a high degree of correlation, reflecting the globalised nature of the world economy.